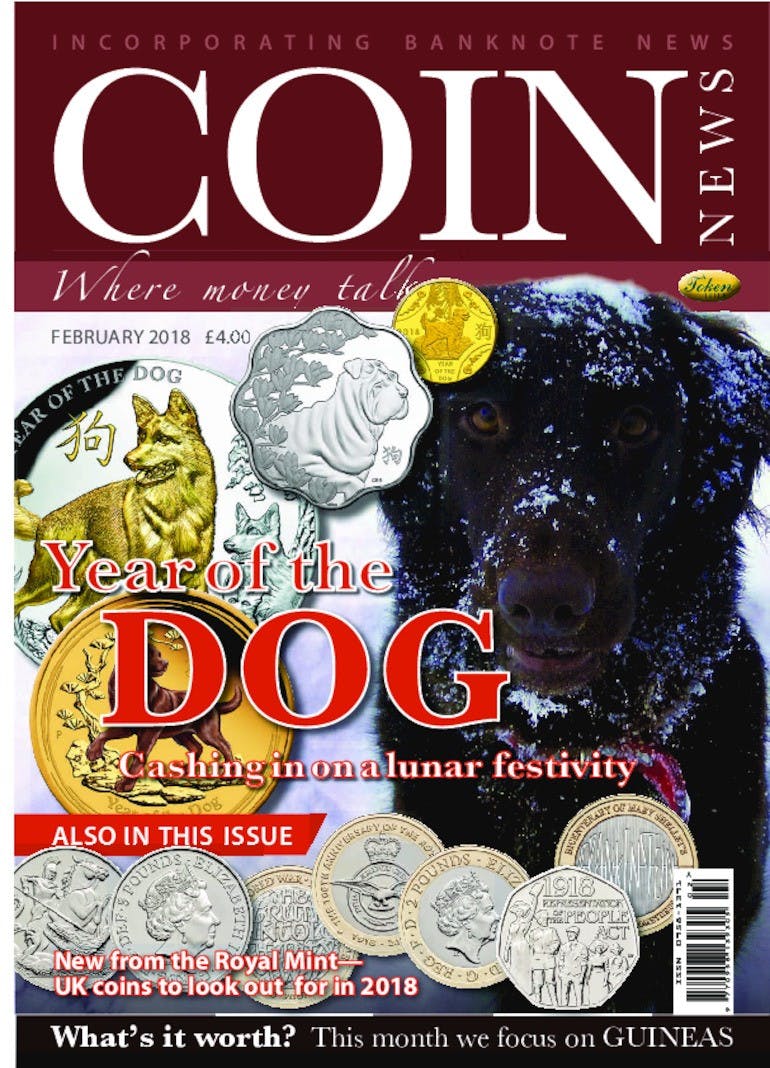

Year of the Dog

Volume 55, Number 2, February 2018

When is a coin not a coin? OK, let’s put this to bed once and for all—COIN NEWS will not be covering Bitcoin in any depth . . . these days it is one of the questions that seems to be on everybody’s lips when I mention coins—they immediately ask whether I know anything about cryptocurrency. I’ve lost track of the number of people who assume I know all about the topic just because I edit a magazine with “coin” in the title. I’m sure you have the same issue, you start talking about denarii, staters, sovereigns or crowns and within a few minutes you find yourself being asked what you think the Bitcoin market is going to do . . . it seems that some people are unable to get past the word “coin” in the name and somehow want to equate it with the things we collect. The media don’t help of course, every story about Bitcoin seems to be illustrated by a picture of a round, shiny metal object with a big B on it and that leads people to start thinking of these things as actual physical coins they can hold in their hands. I won’t give you bell, book and candle on what Bitcoin actually is (other than not a coin), as truth be told I know very little. I know it’s a virtual currency that relies on a blockchain to show whether a particular unit of this currency has been spent or not; it is, apparently, much favoured by those who wish their transactions to be anonymous and away from the eyes of banks and governments (although the very fact that each transaction is logged by the blockchain would worry me—if the fact that it’s been spent is logged then what other info is recorded? Hardly a libertarian’s dream) and it has been in the news very much recently because of its price volatility with one Bitcoin increasing in value from $1,000 at the start of the year to $17,000 as I write this . . . oh no, wait, now it’s down to $15,400, oh wait, back up again and at $17,600 . . . . It really is that volatile and there is much talk of economic bubbles, crashes, losses, fortunes to be made and lost, bandwagons, tulips and the south seas. Not to mention lost wallets, hacks and fraud. The fact is that Bitcoin is a true 21st century phenomenon and by the time you read this it may still be going up and up or it may have crashed, you yourself may have made a fortune or you may have lost it all—we simply don’t know. To my mind the “currency’s” volatility is exactly what makes it useless as a currency at all—the only way you can price anything in Bitcoin is by pegging it to the Dollar, Pound, Euro or Yuan. We couldn’t, for example, say that a Coin Yearbook is worth a set number of Satoshis (one Bitcoin is worth 100,000,000 Satoshis—named after the Bitcoin’s inventor) because today that number would be x, but tomorrow x might be worth twice what it is today and no one would pay in Bitcoin when they could pay in GB£ or it might be worth half what it is today and we would make a loss. You see, the point about a useful currency is that people have to have faith in it, they have to know what it will be worth, roughly, on any given day—this is why hyper-inflation currencies don’t last and revaluation or the scrapping of that currency entirely is always the end result. If you can’t trust the money in your pocket to be worth approximately the same tomorrow as it is today then the economy suffers, badly. It was trust issues and the need for stability that led King Alyattes of Lydia to first put his symbol of a lion on some electrum some 2,500 or more years ago and coins as we know them came into being. He put the lion on the metal to let people know it was real electrum (an alloy of gold and silver), that it was worth what the owner said it was and that it could be exchanged for goods or services that were worth that amount. The person who received that small lump of metal could, in turn, also use it to buy things, the next person along secure in the knowledge that all was well as the King’s stamp guaranteed it—and so on. That’s the point about money, that’s why it works, because people trust in it, they believe in the “promise to pay the bearer the sum of . . .”—and that’s why over the years the penalty for counterfeiting currency and damaging that trust has been very severe indeed (hands cut off or death anyone?). If, for whatever reason, you can’t trust in your currency, chaos ensues. That isn’t to say I am dismissing all cryptocurrencies. Far from it, I believe in time the volatility will abate and they will indeed start to be used more and more in everyday life and they will become just another way to pay. But right now, the flavour of the month, Bitcoin is far too up and down to be of any use to me, especially when I’m not actually sure it will be the one that ends up being used in the mainstream—could it go the way MySpace and Friends Reunited did when Facebook came along? We just don’t know. Of course, if you view it purely as a commodity to be traded rather than as a useful currency to buy things with, that’s a different matter entirely and I am sure that some people will make a lot of money out of the current trend, I won’t be one of them though. Now I wouldn’t dream of giving COIN NEWS readers any investment advice at all and good luck to you if you are investing in these new “currencies”, but personally I’ll probably stick to gold, it might not be as glamorous as Bitcoin nor offer the same dizzying returns on a daily basis, but it’s been around a while. It’s tried, it’s tested and I trust it, so I’m afraid if you picked up COIN NEWS in the hope of finding out more about Bitcoin then you’re in for a disappointment; just because it has coin in its name doesn’t mean it is one—but hang around for a while, you may just find that actual coins, real ones you can see and touch are far more interesting anyway!

Order Back Issue

You can order this item as a back issue, simply click the button below to add it to your shopping basket.