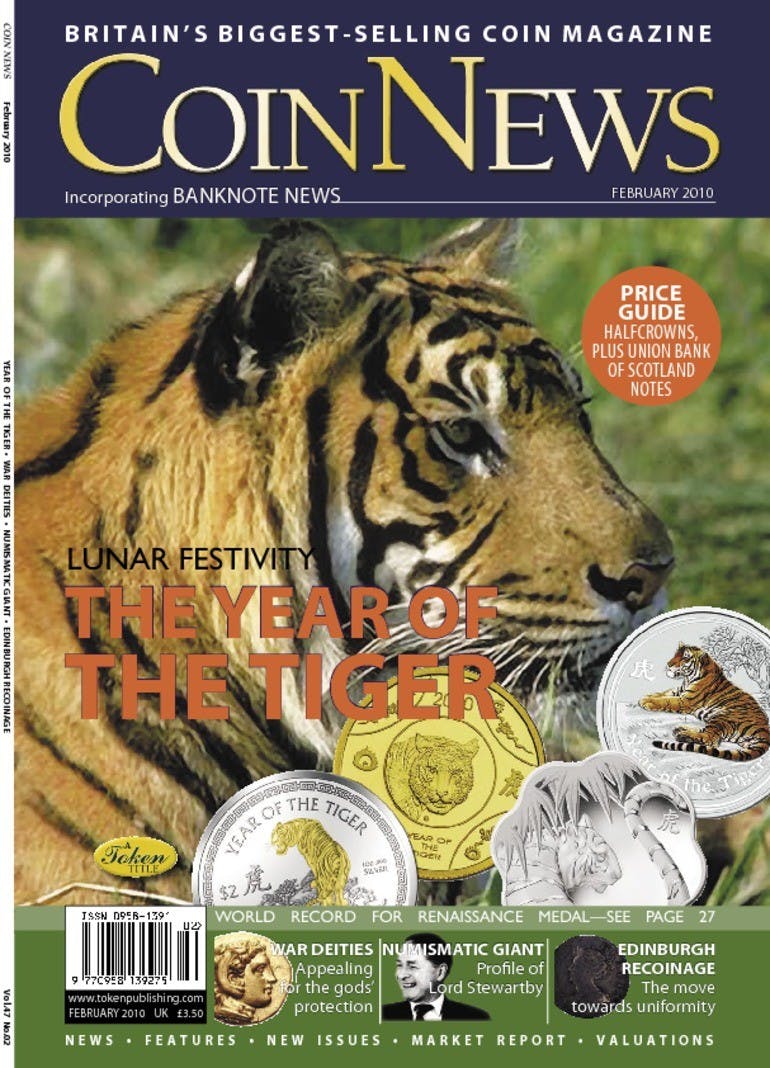

The Year of the Tiger

Volume 47, Number 2, February 2010

A thriving situation . . . IF any further proof were needed that the British (if not the world’s) media loves to look on the bleak side of things then the headlines that cropped up over the festive period were surely enough to convince even the most hardened sceptics. Faced with the fact that during 2009 house prices had, on average, actually gone up; unemployment had stayed below the magic three million; interest rates had stayed at a record low; inflation hadn’t hit the roof and oil remained volatile but nowhere near the disastrous levels seen in 2008, the newspapers, websites and television news channels turned their attention elsewhere—and really started scraping the bottom of the barrel. In headlines such as “Has gold gone cold?”, “Has the gold bubble burst?”, etc., the press sought to worry us that the inexorable rise of the precious metal had come to an end and that anyone who had bought in the past few months was sure to come a cropper. And their basis for this? The fact that the high of over $1,200 an ounce wasn’t sustained and the price of gold fell back a little (and I really do mean a little). But wait a minute—it might have fallen back initially to under $1,100/oz but it still was at dizzying heights and already, as January trading takes off, it is back at near $1,150/oz and climbing—in other words the pundits once again hadn’t got a clue and, as is their wont, they jumped on a bandwagon that actually wasn’t rolling very far at all. The fact is that gold has consistently done well in the past decade, rising over 400 per cent in the ten years since the “dotcom” bubble burst in 2000, and there are no immediate signs of any kind of dramatic correction. Gold is, and continues to look like, a “solid” investment. What though does that have to do with us at COIN NEWS? We’re not an investment magazine so why does the price of gold matter to us? Well, whether we like it or not the investment side of our hobby is pretty big at the moment and whilst I know I’ve spoken about this before it is, I think, worth mentioning again. On the whole our little pastime has done reasonably well out of the “worst recession since the 1930s” (that’ll be the press again)—a look at any auction house’s prices realised or any coin fair bourse will show you that, far from suffering in the midst of a depression, the coin market is actually doing OK. Every month auction records continue to tumble and every month queues to grab the early bargains at the shows grow longer. The BBC, no less, has featured coins and coin shows (the monthly Birmingham show specifically) as being a way to invest for the future and there can be no denying the fact that we are seeing new faces come into the hobby every week — and we all know that many of these are coming in as investors not numismatists. Another reason people are getting so interested in coins and precious metal is the sudden rise of the “we buy your gold” companies all keen to help us out by relieving us of all that unwanted gold we just happen to have lying around. The more astute members of the public are beginning to realise that for these companies to make money in a rising market they might not be giving quite the full market value for the items offered and so we are finding more and more people buying price guides (our own Coin Yearbook has again almost sold out despite printing 3,000 more copies this year than last) and more and more people approaching bona fide coin dealers for an accurate and fair valuation of what they have. The result of all this is that the coin hobby is awash with new people, and of course new money, and that has to be a good thing. Yes, it is true many of these people won’t stay coin collectors forever and many sceptics will point to the fact that when the stock market stabilises these investors will move their money back into stocks and shares—but may I respectfully point out that the FTSE has actually been rising steadily for the past twelve months and as I write this in January 2010 it now stands a full 2,000 points above what it was in March 2009—has the coin market shrunk in a similar way? Has the price of gold tumbled to reflect the return to the more standard trading in the city? Quite simply, no, and that’s something I think we should be very grateful for. Too often the purist numismatists have looked down on the investors with disdain, they have felt that those with a lot of spare cash but not much knowledge shouldn’t really be considered collectors like the rest of us. But may I put it to you that without these investors, without those willing to spend their money on coins—for whatever reason—this hobby and trade would not be in the enviably strong position it is now. I have no idea what 2010 will bring for any of us but I do know that now that Christmas is over and a new year is beginning, all of us should look back at 2009, breathe a little sigh of relief and thank our lucky stars that, despite the doomsayers in the national press, the bubbles haven’t been bursting and actually we are all still doing alright. So, next time you hear of someone buying sovereigns as a nest egg or moving his money out of the FTSE and into numismatics, don’t turn up your nose at his plans, rather you should shake him by the hand and thank him for allowing the hobby you love so much to thrive!

Order Back Issue

You can order this item as a back issue, simply click the button below to add it to your shopping basket.