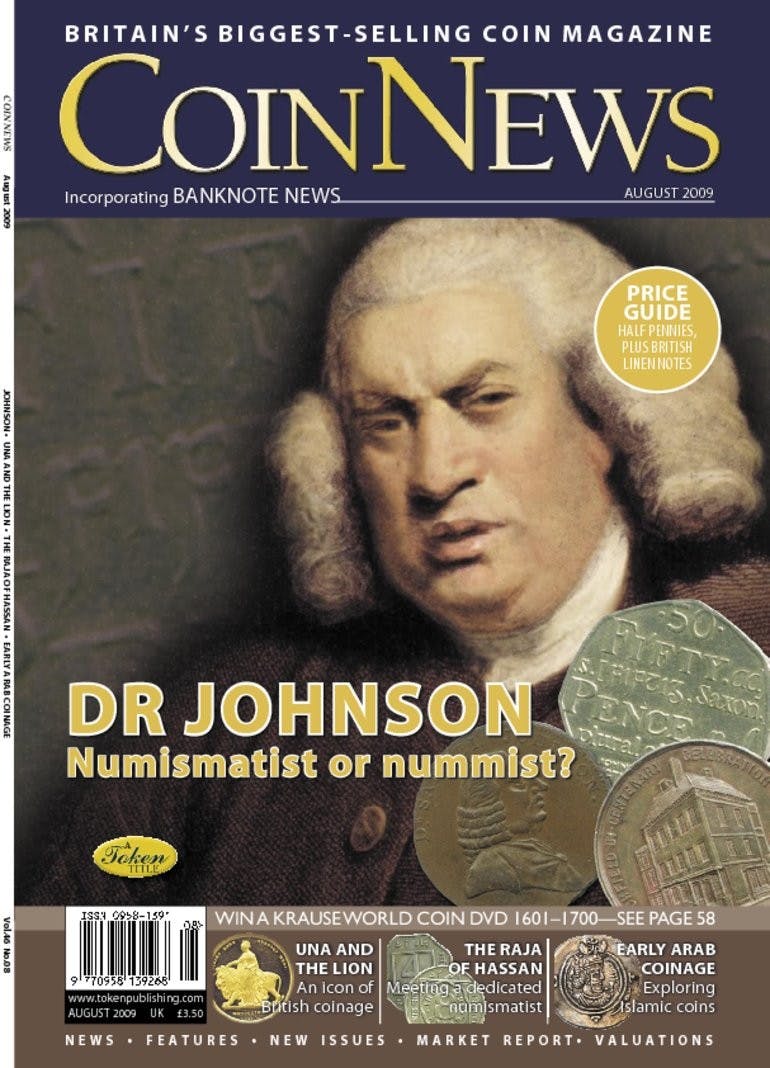

Dr Johnson

Volume 46, Number 8, August 2009

AMAZING isn’t it — we at COIN NEWS break a story in December and it takes the rest of the media a full six months or more to pick up on it, ahead of the game or what?! I refer, of course, to the story of the 20p without a date—the unfortunate error that came out of the Royal Mint last year, marrying the type I 20p obverse (1982–March 2008) to the type II 20p reverse (April 2008 onwards), a coupling that resulted in the fi rst undated circulating coin since the reign of Charles II. Now we “in the know” have been looking out for these coins all this year, a number have come across my desk for authentication and I have pointed various collectors in the right direction when it comes to selling them. We have watched the price fl uctuate between £120 to around £35, with the “experts” confi dent that, as more came to light (exact numbers are unknown but it’s estimated there are anything from 100,000 to 200,000 out there somewhere), so the asking price would decrease to anything from £5 to £20. Then, in a slow news week, when the British public were fed up with stories of dead American celebrities and Murray was making heavy weather of the quarter fi nals at Wimbledon, the papers and other media picked up on the press release sent out by the London Mint Office regarding these mules and all hell broke loose. Suddenly Philip, our “media man”, was in demand again and found himself having to endlessly regurgitate a story we all thought dead in the water and the newspapers, websites, television, et al, were full of tales of people making a fortune out of the humble 20p. Unsurprisingly, eBay was the focus of much of the hype with vendors asking simply ridiculous sums for these errors — the record being a “Buy it Now” Price of £1.2 million (why a serious collector didn’t jump at the chance to buy that one I’ll never know?!). It was reported that one of these coins had actually sold on eBay (in its auction format) for over £7,000 but nobody actually knows whether that transaction was ever completed or whether the vendor was the victim of a scam where the “buyer” takes the bidding up to a ridiculous level just to annoy the seller then doesn’t complete the deal, leaving the eBayer with a hefty seller’s fee and a red face. Assuming both the £1.2 million and the £7,000+ price tags were mere fantasy, the fact remains that a good number of these coins were being traded at sums of money that don’t really bare any relation to their numismatic worth (if you consider the selling price of the much rarer 2p 1983 error) and I can’t help but think that when the hype dies down, as it certainly will, we will find ourselves facing that age old problem—the secondary market not living up to the primary one. The scenario is thus—we at COIN NEWS broke the story of the mule 20p in December last year, we have to assume that most “serious” coin collectors either read the magazine or at least know of it. Therefore, any one with a keen numismatic interest in these pieces would have bought one a while ago. Maybe they paid the initial price of £100+, or maybe they were a tad more canny and waited a little until the price dropped, either way the chances are those with a real interest in modern errors will now own an undated 20p. The conclusion therefore must be that those paying the infl ated prices now are not “serious” collectors but rather members of the public hoping to jump on a band wagon and cash in at a later date. The trouble is who are they going to cash in with? If the collectors already own their coins, the London Mint Offi ce are “only” paying £50 (and then one suspects that the need to register your details with them before selling your coin means that they are looking more at a name gathering and PR exercise than a serious desire to buy up lots of 20 pence pieces) and still more are likely to be found in the future, so just how is money going to be made? I have visions of disgruntled buyers moaning at us at future coin fairs as they try and fail to sell their eBay purchases for vast profi t. But then if that is the case, just who is to blame? Certainly not the coin trade, not the London Mint Offi ce, not the media—all have been valuing these coins at £50 or below so, if these speculators get burned I am afraid that they really have no-one to blame but themselves. That being the case I fi nd myself somewhat ambivalent about their possible plight—if a group of “investors” has decided they are willing to pay a large amount of money for something that those in the know consider excessive then, so what? That’s their choice—what we as a hobby will take from this isn’t the worry about a bubble bursting but rather the knowledge that actually everyone of us out there is secretly a coin collector just like us—but then we already knew that didn’t we? They just won’t admit it!

Order Back Issue

You can order this item as a back issue, simply click the button below to add it to your shopping basket.