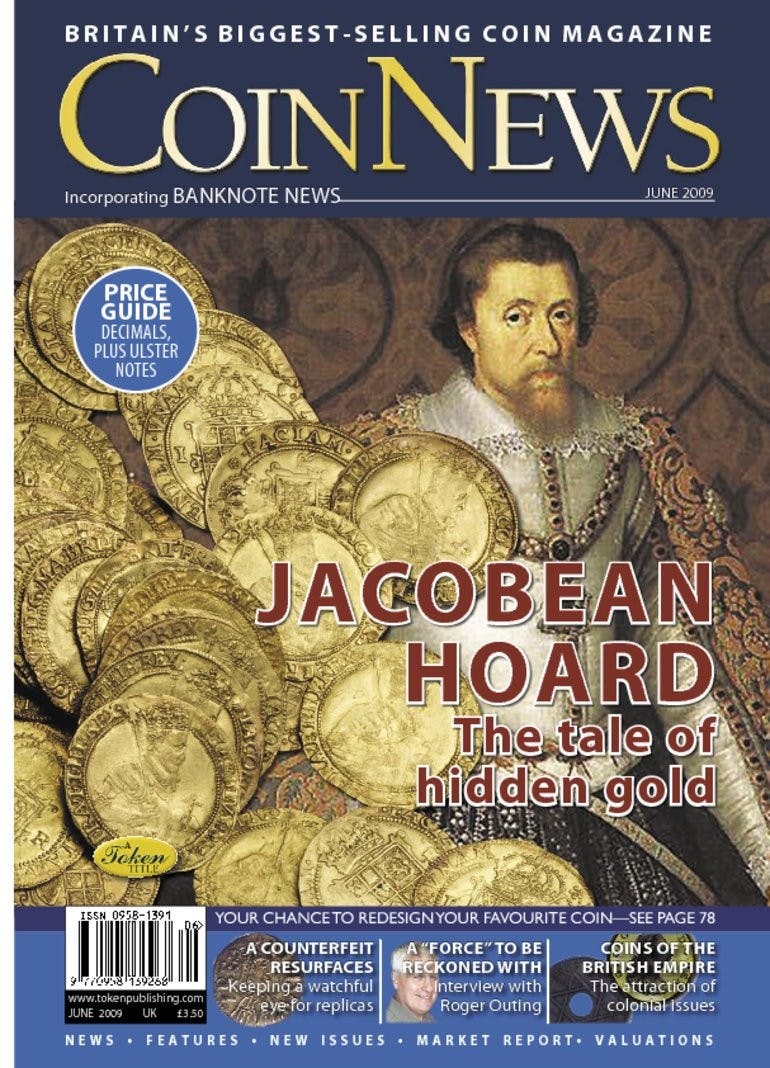

Jacobean Hoard

Volume 46, Number 6, June 2009

A rosy future A QUICK glance at the News and Views or indeed the Market Scene this month will reveal another raft of bumper sales, records broken, profits up and success upon success in the numismatic world. The Royal Mint has had a bumper year, Noble Investments have had a bumper year; in the US Heritage Auction Galleries have had a bumper year (culminating in the magnificent $2.3 million paid for the 1804 dollar at their sale at the end of April) and on the other side of the globe the Australians are having a bumper year too with still more to come. All the auction houses in the UK are reporting sales results that are stronger than ever with a new record being set for a Spink paper money auction and other salesrooms proving just as profitable. On-line auctions too are going from strength to strength and we continue to see huge prices being made across the board—so just what is driving this numismatic boom? And, more importantly will it follow the wider economic cycle and one day turn to bust? Well the first question is an easy one to answer—as I pointed out in the March Editor’s Comment the global recession has led to a dearth of places where money is safe, let alone where it’s earning any kind of return. Banks are no longer seen as safe havens and even those not in danger of collapse aren’t giving savers any decent rates at all; the stock market is so volatile as to be downright scary and with the dangers of inflation still threatening, the mattress hardly looks inviting—so people are turning to alternative investments. And whether we numismatists like it or not coins and notes are high on their list. Indeed with the intrinsic value of the metal content of many pieces giving that added element of security, coins in particular are proving extremely popular amongst those who still do have a bit of spare cash to spend (and they are out there—you can’t believe everything you read in the ’papers). So that’s why we still see records being broken, still see the coin fairs well attended, still see the on-line auction prices shooting up and still see the numismatic world as a whole doing well. But will it last . . . ? Well of course that’s the question that we simply can’t answer (if only we could), but we can hazard a guess or two. Over the past few years the hobby has been going through something of a renaissance—many of you will remember the heady days of the 1970s before the bust that followed the Hunt brothers’ attempts to corner the world silver market and whilst the late ’nineties and most of the “noughties” haven’t been quite that crazy, you must remember that what we’re seeing at the moment isn’t actually a boom per se but rather the continued upward trend in the popularity of coins and banknotes. We aren’t having an odd “blip” at the moment, caused solely by investors rushing headlong to buy up anything they can get their hands on, but rather we are seeing “more of the same”, more of what has been happening for well over a decade now. Admittedly it feels like a boom because so many other sectors of the economy are going backwards whilst our hobby continues to thrive, but it isn’t that simple. Yes, there are investors in the market and that’s keeping it buoyant, but it isn’t JUST investors that are buying, bona fide coin collectors are too and that’s going to help ensure that perhaps we might be all right after all . . . ! The reason I say this is fairly straightforward—if we were only seeing investors buying up stock then we would all know that in time everything they have purchased would come back on the market and history tells us that often it comes back in one big lump as one “commodity” falls out of favour and another becomes popular. This would drive prices down and leave a number of people out of pocket—you only have to look at the boom in the property market, the rise in popularity of “buy to let” and the subsequent problems faced by many would-be investors there to see the model in action. However, when you have genuine collectors buying too then the worries of a bust are lessened. They may well be buying for the same reason as the investor—because their spare money is wasted anywhere else—but the difference is they are far less likely to be keen to dispose of their new acquisitions when all this is over. We all know what it’s like—we buy something for our collections with the intention of selling something else to pay for it but can’t quite bear to part with anything. The same will happen now—all those collectors buying because their money isn’t working elsewhere are also buying because they love the hobby and enjoy having coins—they won’t all be in a great hurry to sell their new purchases the moment things get a little more stable you can be sure of that. Yes, some will sell, of course they will, but there won’t be a sudden glut of material landing on the market the moment the stock market stabilises or interest rates go back up. Yes, things may well calm down, and in some cases that would be no bad thing, but as long as there are collectors out there as well as investors this hobby has a future and a rosy one at that.

Order Back Issue

You can order this item as a back issue, simply click the button below to add it to your shopping basket.