Collectors rule OK!

Volume 40, Number 7, July 2003

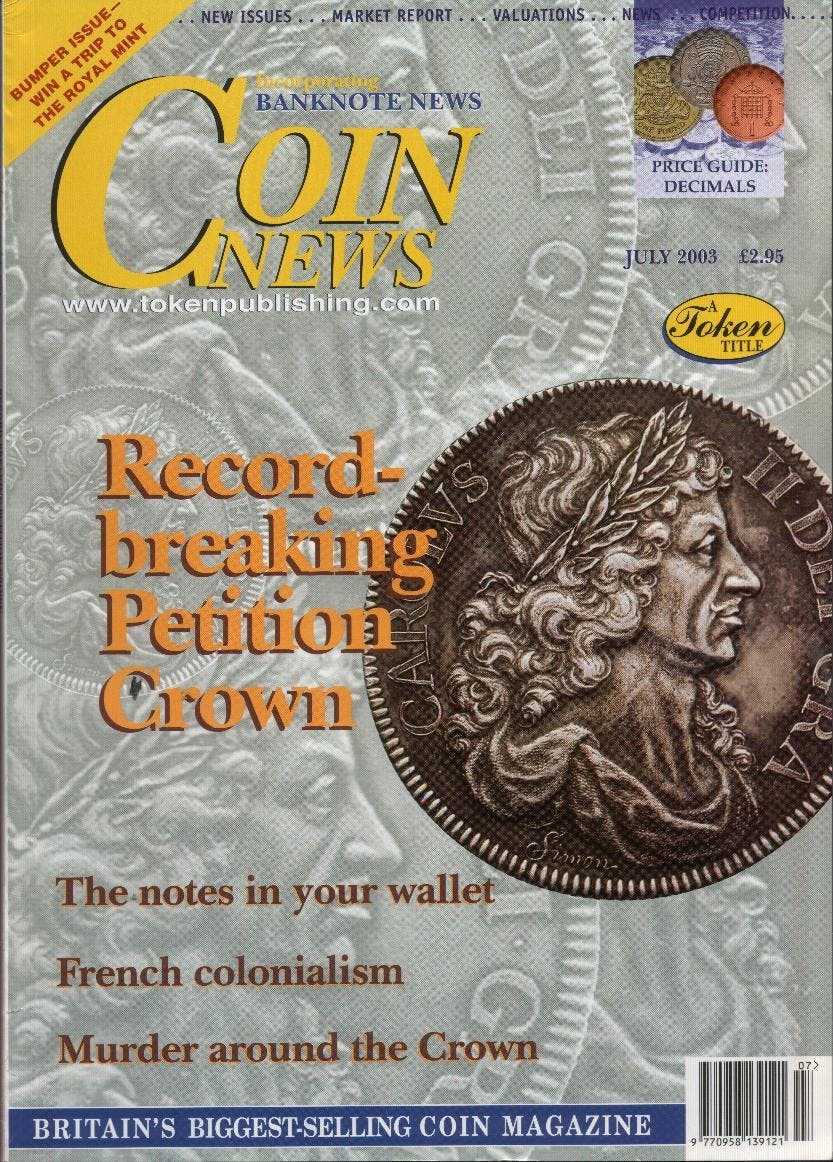

It cannot have escaped any collector’s notice that prices of coins seem to being going up; in a world where there is much talk of recession, slowing economies, slumps, boom and bust et al the coin trade seems as buoyant as ever. A quick look at just a few of the recent “prices realised” from the major sale rooms across the country will show you that despite slowing house prices, a tumbling stock market and an uncertain economic future there is still money out there – and a lot of it. This month’s market scene tells of phenomenal prices paid for both Paper money, with a Palestine currency board £100 fetching £48,000 at Spink and an 1849 Portsmouth Branch “White Fiver” fetching £20,700 at Bonhams, and for coins with a 1642 Charles I Unite fetched £13,225 at Bonhams and of course the Slaney Collection Sale at Spink topping all records, the highlight being the Petition Crown that sold for £138,000. So what does this mean for our hobby? Are we seeing a return of the huge price rises of the late Seventies with an early eighties style “bubble burst” as the inevitable consequence? Are investors coming back into the coin market in their droves as interest rates stay too low to make banks worthwhile and the stock market has proved that it can indeed go down as well as up? Are we going to see the finest pieces snapped up by “non-collectors” intent on simply putting their money into something, anything, that might give them a return thus creating a false market until such time as they decide to off load their accumulations again? Possibly, after all even amongst the absolute purists who don’t care anything for the monetary value of their collections there are few of us who would expect our coins to be worth less than we paid for them; we all expect some kind of return so why wouldn’t speculators feel the same? It has happened before so why couldn’t it happen again? It could but the general consensus is that it isn’t happening now. Back in the Seventies it wasn’t just coins that investors turned to, other collectables especially stamps, antiques etc all benefited from the “collector boom” but that hasn’t happened this time. Certainly the medal world is as, if not more, buoyant than coins but the reasons for that buoyancy are the same in both hobbies and owe nothing to outside speculators and false markets. It is the simple economics of supply and demand that are keeping the numismatic world so upbeat. The choice pieces just aren’t around like they used to be and as such when they do come on the market they are snapped up – and the people snapping them up are true collectors who have been waiting for years to own such a coin. The petition crown is a classic example so few crowns were produced that for one to come on the market is a rare occurrence, when it does there are dozens of eager collectors waiting for the chance to own it, this inevitably pushes up the price. What we are seeing today isn’t the result of a new wave of moneymen with no knowledge pushing up prices willy-nilly. It is in fact the opposite, it is a new wave of collectors all of whom have enough knowledge to realise the true worth of the coins that they are buying and the knowledge to know that such pieces come on the market all too rarely. Those same collectors know full well that when such gems come up in auction or on lists there is no time to be timid, no time to um and ah for those coins will be bought by someone and will disappear into collections for many years and therefore he who wants a particular coin, and can afford it, must strike whilst he can as he might not get another chance. It is that that is pushing up the prices and promises to do so for quite some time to come. The end result is, of course, the same – that prices go up, but at least this way we know that there won’t suddenly be huge repercussions as the bubble bursts, there is no bubble to burst, this isn’t a false scenario this is how it is and how it looks set on staying.

Order Back Issue

You can order this item as a back issue, simply click the button below to add it to your shopping basket.